For other Islamic State primary source material on Zakat, see:

. The Islamic State's System of Zakat

. Islamic State Pamphlet on Zakat

-------------------------------------

The following post consists of various fatwas that were issued by the Research and Fatwa-Issuing Diwan/Commission (later the Office of Research and Studies) on matters of Zakat. For general background on fatwa-issuing activities of the department/office, see here. As I understand these particular fatwas were originally issued on the Islamic State's radio program of Idha'at al-Bayan. They have been transcribed in text form though not all of the ones I found in written form were completely transcribed. Any other Islamic State fatwas I find on Zakat will be added to this archive. In the translations, any parenthetical insertions in square brackets are my own.

------------------------------------------

Fatwa no. 932:

Question: A brother has property outside the lands of the Islamic State. So is Zakat upon him obligatory?

Answer: If this property is of the wealth upon which Zakat is obligatory, and it is of four kinds...[then Zakat is due upon it?].

Fatwa no. 935

Question: If I own two rings of gold, do I pay Zakat for the second ring that I have worn in consideration of it as going beyond adornment?

Answer: The majority of the 'ulama from the Malikis, Shafi'is and Hanbalis have taken the view that there is no Zakat on jewellery made ready for adornment, except if it is kanz, and therefore: the ring by which you adorn yourself, there is no Zakat on it in the more correct of the two pronouncements of the 'ulama. As for the other ring, if the woman asking the question does not use it for adornment, and she does not alternate in wearing it with the other, Zakat is obligatory on it if its weight reaches the nisab and the nisab of pure gold- which is 24-carat in measure- is what equals around 85 grams. As for when it does not reach the nisab, there is no Zakat on it, and God knows best.

Fatwa no. 939:

Question: A woman asks: I have a quantity of gold and some of it I gave as a debt, and the gold that I gave as a debt as not been in my possession for a period of four years. So is the taking out of the Zakat to include the borrowed gold? And is the paying of its Zakat to be for four years? And how much is the nisab of Zakat on gold? And what is the percentage of Zakat on gold?

Answer: If the debt is a state one must consider: if the debt is on a person in difficult circumstances, she does not pay Zakat on it except for one year on the time of receipt, and if the debt is on a well-to-do person, she pays Zakat on it for each year and she may delay the taking out of the Zakat until the time of receipt so she pays Zakat for each year. As for the nisab of the gold, it is 20 dinars: i.e. what equals 85 grams of 24-carat gold or 97 grams of 21-carat gold. And of course there must be the passing of an entire year upon it for the Zakat to be obligatory on it. And as for the percentage of Zakat on gold, it is 2.5%, and God knows best.

Fatwa no. 940:

Question: A poor woman swindled the Zakat centre and took two shares and this woman has died. Are her heirs obliged to return the money to the Zakat centre?

Answer: This wealth that this woman took without right is of the wealth of the fuqara' in Zakat that must be returned. It is not permitted for the heirs to make use of it. For if they make use of it, they must return its value. For in the two Sahih collections on the authority of Salima bin al-Akwa' (may God be pleased with him) who said: 'We were sitting with the Prophet (SAWS) when a funeral prayer was brought so they said: pray for it. He said: Is there a debt upon him? They said: No. He said: Has he left anything? They said: No. So he prayed for him. Then another funeral prayer was brought so they said: oh Messenger of God, pray for it. He said: Is there a debt upon him? It was said: Yes. He said: Has he left anything? They said: three dinars. So he prayed for it. Then the third was brought so they said: pray for it. He said: has he left anything? They said: No. He said: Is there a debt upon him? They said: three dinars. He said: pray for your companion.'

So here the Prophet (SAWS) rejected praying for the one who has a debt and did not leave that by which he could pay his debt, in order to encourage the people to restore debts on behalf of their dead. So this is all the more so for the one who has been usurping the wealth of the Muslims and swindling the rights of their fuqara', and I advise the heirs to increase the charity on behalf of this woman. Perhaps God will forgive her for the crime her hands have committed, and God is the One whose help is to be sought. And God knows best.

Fatwa no. 950

Question: A man has a lot of wealth and when they requested him to pay the Zakat, he lied and did not inform them of the entire wealth and he made a false oath. So what is his ruling?

Answer: To God we belong and to Him do we return. This man who has prevented the right of God and the right of the fuqara' and has concealed and lied is an oppressive man, ignorant and deceived. Has he not known that the One who granted him this wealth will ask him on the Day of Judgment about the worthless and expensive, the small and the big, and the precious and lowly? He has not read the words of God Almighty? 'And those who hoard gold and silver and do not spend them in the path of God, convey to them tidings of a painful torment'- (al-Tawba 34). Has there not reached him the hadith of Abu Huraira (may God be pleased with him) that Muslim narrated in his Sahih collection, who said: the Messenger of God said: 'The owner of gold or silver who does not pay from them the right due upon them will have sheets prepared for him by fire on the Day of Judgement so they will be heated in the Hellfire and so by them his side, brow and back will be branded. Whenever they grow cold, they will be returned to him on a day whose extent is 50,000 years, until he is judged among the servants so he sees his path' or 'so he sees his path either to Paradise or to Hellfire.' We seek refuge in God from the Hellfire, and it has been narrated on the authority of Ali bin Abi Talib (may God be pleased with him) that the preventer of Zakat has been cursed, and it has been narrated on the authority of Abdullah bin Mas'oud (may God be pleased with him) that he said: 'The lawi of charity- that is, the one who prevents it- will be cursed on the tongue of Muhammad (SAWS) on the Day of Judgement.' And it has been established from him- that is, Abdullah bin Mas'oud (may God be pleased with him and please him)- that he said: 'Whoso does not fulfil his Zakat, there is no prayer for him'; and that he said: 'The one who prevents Zakat is not a Muslim.' And Sufyan al-Thawri- may God have mercy on him- said: 'People are entrusted to give their Zakat just as they are entrusted to perform their prayer.' And there have been multiple corroborating hadiths from the trusted Prophet (SAWS) that Zakat is the third of the pillars of Islam after the two shahadas and prayer. So does the house arise without pillars? Then let this man, whom God enriched and blessed from His grace, know that by his taking out of Zakat, he cleanses his wealth and grows. God Almighty has said: 'And what you have brought from Zakat as you seek the face of God, those people are the ones who will be multiplied in their blessings'- (al-Rum 39). And Jaber bin Abdullah (may God be pleased with them both) said: 'When you perform the Zakat on what you have, you ward off its evil from you.' And let this man know that he has fallen into accumulated sins of the great sins, for he has prevented his Zakat and lied in that and sworn falsely upon it. So let him fear God and hurry in repentance to God the Exalted and Almighty and take out the necessary Zakat upon him and increase charity and seeking forgiveness. And God is the One whose help is to be sought.

Fatwa no. 951

Question: A man asks about the extent of the nisab of Zakat from trade offers in money?

Answer: The nisab of Zakat on any currency that is used is what equals the value of the stipulated Shari'i nisab for that currency, and the Shari'i nisab is 100 silver dirhams [sic: should be 200 dirhams] or 20 gold dinars, and 100 dirhams of silver equals 595 grams, and 85 grams of gold, and the Diwan al-Zakat has adopted the nisab of silver in assessing value out of regard for the right of the fuqara' and their interest, as it is more beneficial for the fuqara' and the deserving. And in order to know the nisab one must know the price of the gram of silver on the day the Zakat is taken out, because it varies constantly in rising and falling as opposed to the lira for example or the dollar, so the price of the gram of silver is known and multiplied by 595 and that is the nisab of silver. This is so and God Almighty knows best.

Fatwa no. 957

Question: what is the difference between the faqir and the maskeen?

Answer: the Ahl al-'Ilm have differed on distinguishing between the faqir and the maskeen. And what is apparent is that the term faqir and maskeen, when the two separate, they come together, and when the two come together they separate [i.e. the terms both refer to categories of poor people, but different categories]. So the faqir is the one who does not the means to pay his need and the need of his dependents, from food, drink and clothing and residence in that he does not find anything or he finds less than half of the sufficiency. As for the maskeen, he finds half his sufficiency or more than half, like the one who has 100 and needs 200, as the general lines of evidence have indicated. And God knows best.

Fatwa no. 962

Question: Is it permitted to give Zakat to the one who disobeys his parents?

Answer: if he description of faqr or maskana or the like from the categories of people deserving Zakat, he thus becomes deserving of it and his disobedience is not considered an obstacle, but the brothers in the Diwan al-Zakat who know his state must admonish him, rebuke him and advise him, for advice from them is more conducive to acceptance with him, and God knows best.

Fatwa no. 964

Question: I have a car and I bought it for business. Is there Zakat on it?

Answer: If you bought the car for the intention of selling it, on it is the Zakat of trade offers. As for if you bought it to make use of it, like a taxi car and the like, there is no Zakat on it itself, but rather the Zakat is on the money that you earn from it and the year has passed on it, and God Almighty knows best.

Fatwa no. 965

Question: I have a sum of $3000 I have kept for my wife so she can make use of it in the event of my death. Am I obliged to give Zakat on it?

Answer: Yes. The aforementioned sum has reached the nisab so on it is Zakat whenever the year passes on it. And God knows best.

Fatwa no. 968:

Question: a person on the line says that he has three oil tankers, and he manages the tankers with 2,000,000 Syrian pounds. So how does he take out Zakat?

Answer: As for the tankers, there is no Zakat on them, and the Zakat is obligatory on him in the wealth that he has which he has prepared for business, whether capital or profits. He adds them together every year (he adds the capital and profits and value of the oil or the petrol that he has), then he takes out 2.5% from their value entirely, and that is the Zakat of the trade offers, and God Almighty knows best.

Fatwa no. 972

Question: What are trade offers?

Answer: Offers is the plural of 'offer' and it is what the Muslim has prepared for business from any kind and it is the most general and comprehensive of the wealth of Zakat. It has been called as such because it is not kept in one place but rather displayed then it goes away. This is because the businessman does not want this item per se but rather he wants to make profit out of it from the two monies [gold and silver], and in God is the granting of success.

Fatwa no. 973

Question: One of them asks about the jewellery of his wife that she wears for adornment. Is there Zakat on it?

Answer: The Ahl al-'Ilm (may God have mercy on them) differed on the ruling of Zakat on jewellery prepared for use, for the majority of the Ahl al-'Ilm (may God have mercy on them) have held the view that there is no Zakat on jewellery prepared for use, and some of them have taken the view of its obligation, and the more likely correct view is that there is no Zakat on it, and all that has come on the obligation of Zakat on jewellery is not devoid of weakness in narration, and if there were to be Zakat once that is fine, for what has been established on the authority of Anas (may God be pleased with him): that he said: 'If jewellery is lent and worn, there should be Zakat on it once.' And God knows best.

Fatwa no. 977

Question: When is Zakat al-Fitr paid and how much is its value and is it permitted to bring it out as money or it must be brought out as food?

Answer: The charity of al-Fitr is an act of worship mandated by God Almighty as cleansing for the faster and bringing joy to the faqir who does not find his daily nourishment, and it is from the spirit of cooperation on piety and fear of God and conciliation and mutual love among the Muslims. And it is obligatory on every Muslim who has owned from wealth what has exceeded his provision and the provision of his dependents on the day and night of Eid. So he must bring out Zakat from himself, his spouse, child, servant, slave and for whom he must spend like parents and others besides them. This is because of what has been in the authentic hadith from the hadith of Ibn Amro (may God be pleased with them both): he said: 'The Messenger of God (SAWS) imposed as Zakat al-Fitr a sa' of dates or a sa' of barley on the slave and the free, the male and the female and the young and the old of the Muslims. And he ordered for it to be done before the people came out to prayers.' And it is an act of worship that must have in terms of intention the particular that this food brought out is charity of Fitr, and it is only allowed to bring it out as goods according to the predominant correct opinion from the pronouncements of the Ahl al-'Ilm. So it is not allowed for it to be brought out as wealth but rather it should be brought out from food or from the nourishment of the people of the land. And this is the view adopted by the majority of the 'ulama of the Ummah in predecessors and successors. As for what concerns the details of its extent in contemporary weights, our brothers in the Diwan al-Zakat (may God reward them best) have issued a detailed publication on that, so go and see the centres of Zakat and their offices, and God knows best.

Fatwa no. 979

Question: Is a person who does not pray to be given something from the wealth of Zakat?

Answer: Praise be to God and it has sufficed, and prayers and peace be upon the Prophet al-Mustafa, and on his family and companions, and whoso has followed his Sunna. As for what follows: The one who abandons prayer is not to given anything from Zakat. And it has come in the two Sahih collections on the authority of Ibn Abbas (may God be pleased with them both): that the prophet (God's peace and blessings be upon him and his family) sent Mu'adh (may God be pleased with him and please him) to Yemen so he said: 'Call them to the shahada that there is no deity but God, and that I am the Messenger of God. So if they obey for that, then teach them that God has imposed on them five prayers each day and night, so if they obey for that, teach them that God has imposed on them a charity on their wealth that is to be taken from their wealthy and rendered unto their poor.' So the Prophet (God's blessings and peace be upon him and his family) said: 'And rendered unto their poor.' Who are these poor? These people are the ones who have testified the two shahadas and have established the prayer as has come in the text of the hadith, and there is no doubt that the texts from the Book of God Almighty and from the Sunna of the Messenger of God (God's peace and blessings be upon him and his family) have indicated the kufr of the one who abandons prayer. God Almighty has said: 'So if they repent and establish prayer and give Zakat, they are your brothers in religion.' And on the authority of Abdullah bin Barida from his father who said: I heard the Messenger of God (God's peace and blessings be upon him and his family) saying: 'The pact that is between us and them is prayer, so whoso abandons it has disbelieved'- narrated by Imam Ahmad. So the obligation on the questioner and on every Muslim who is aware from the state of a person that he has abandoned prayer is to advise him first. If he does not respond, he must refer his affair to the Hisba. And in God is the granting of success.

Fatwa no. 980

Question: Is there Zakat on the owner of the grocery store?

Answer: God has imposed Zakat on specified kinds of wealth and they are gold, silver and what is joined to them in the obligation of Zakat is paper money because it is in the rank of money, and likewise the grazing livestock from camels, cattle, sheep and likewise what comes out from the earth from grains and fruits that are measured and stored and likewise trade offers. So these types are the ones on which God has imposed Zakat. And as for trade offers, they are all that is prepared for selling and buying with the intention of profit, whether it is from goods, real estate, clothing, machines and the like from what has been prepared for business. So Zakat on this is obligatory, and this is the opinion of the majority of the 'ulama. And the evidence for that is the words of God Almighty: 'Oh you who have believed, spread from good things of what you have earned'- (al-Baqara 267). And Imam al-Bukhari (may God have mercy on him) included a title in the 'Book of Zakat' in in his authentic collection and said: 'The chapter on charity of earning and business on account of the Almighty's words: 'Oh you who have believed, spread from good things of what you have earned." And Imam al-Baihaqi and Ibn Abi Shaiba in his Musannaf narrated on the authority of Ibn Omar (may God be pleased with them both), who said: 'There is no Zakat on offers except in an offer in business, so on it is Zakat.' And the condition on the wealth prepared for earning and business in order for Zakat to be obligatory on it is...[no further text given, but see general Zakat guide for more].

Fatwa no. 981

Question: I have $550. If the year passes on the sum, is there Zakat on it? And what is its extent?

Answer: Yes there is Zakat on it because the aforementioned sum has reached the nisab and the extent of the Zakat is 2.5%, and the aforementioned sum's Zakat is around $14. And God Almighty knows best.

Fatwa no. 982

Question: Is there Zakat on the woman's jewellery?

Answer: There is no Zakat on the jewellery of the woman used for adornment unless it takes the form of kanz, and kanz is storage. And this is the position of the majority of the Malikis, Shafi'is and Hanbalis. Imam Ahmad (may God have mercy on him) said: 'Five of the companions of the Messenger of God (SAWS) say there is no Zakat on jewellery.' And as for what those who assert the obligation of Zakat on jewellery cite, it is either authentic and not clear, or it is clear and not authentic. And God knows best.

Fatwa no. 983

Question: Is there Zakat on the wealth of the orphan if it reaches the nisab and if the Zakat is taken out, the wealth will be diminished and when he reaches his age of maturity he will not find anything from it? So what do you advise?

Answer: it is obligatory to take out Zakat on the wealth of the orphan in the predominant correct opinion from the pronouncements of the Ahl al-'Ilm because Zakat is a right of wealth and there is no connection between it, maturity and cost and the like. And many traces have been narrated from the jurists of the companions (may God be pleased with them) on bringing Zakat on the wealth of the orphan. And the companions (may God be pleased with them) have understood what the sister asking the question mentioned and it is that prolonging the taking out of Zakat on the wealth of the orphan diminishes it. So in the Musannaf of Abd al-Razzaq on the authority al-Qasim bin Muhammad bin Abi Bakr al-Siddiq (may God be pleased with him) who said: 'We were orphans in the care of A'isha the Mother of the Believers (may God be pleased with her) so she used to pay Zakat on our wealth, then she paid him a loan, so it was blessed for us in it.' That is, she gave it to the one who was doing business for them with this wealth. And in al-Mawta' Imam Malik on the authority of the Amir al-Mu'mineen Omar bin al-Khattab (may God be pleased with him): that he said: 'Do business with the wealth of the orphans that the Zakat does not eat up.' And in the narration of Abd al-Razzaq: 'Perform business with the wealth of the orphans and give the charity on it.' And on the authority of the Amir al-Mu'mineen Ali bin Abi Talib (may God be pleased with him): that he gave Zakat on the wealth of the orphan children of Abu Rafi' in his care so he said: 'Do you want there to be wealth with on which I do not perform Zakat?!' And the obligation of bringing out Zakat on the wealth of the orphan has been established on the authority of Abdullah bin Omar and Jaber bin Abdullah (may God be pleased with him) and on the authority of al-Sha'abi and Ibn Sirin and Tawous and Ata' and others besides them. And this is the position of the three imams al-Shafi'i and Malek and Ahmad (may God have mercy on them all). So we advise the sister asking the question to make efforts to do business with this wealth and give it to the one in whom she finds justice, trust and confidence in order that he should do business with this wealth and make profit on it so she may fulfil Zakat from this profit and the wealth remains preserved for these orphans when they reach their age of maturity. And God knows best.

Fatwa no. 992

Question: for which relatives is Zakat on wealth permitted and for which ones it is not permitted?

Answer: The 'ulama (may God have mercy on them) have agreed by consensus that it is not permitted to pay Zakat to those for whose expenditure man is responsible. And at the head of them are origins and branches, and they are parents and children. Imam Ibn al-Mundhir (may God have mercy on him) said: 'The 'ulama have agreed by consensus that it is not permitted to pay Zakat to parents and the child in the event one is obliged to spend on them.' And this is the principle, so it is not permitted for the Zakat giver to pay his Zakat to origins and branches, and they are parents and children, unless the giver of Zakat is unable to spend for his grown children, or his parents who are unable to earn provision, such as one of them being chronically ill, or being capable of earning but the earning does no suffice for him and does not fulfil his needs, or he is in debt and cannot pay it. So in this case some of the Ahl al-'Ilm (may God have mercy on them) permitted paying it to them. The Sheikh of Islam Ibn Taymiyya (may God have mercy on him) said: 'And it is permitted to disburse Zakat to the parents, even if they are higher, and to the child even if he is lower, if they are fuqara' and he is unable to spend for them, and likewise if they are gharimeen.' As for if the giver of Zakat is rich and he is able to spend for his parents or children, it is not permitted for him to pay them the Zakat in the view of the Ahl al-'Ilm in general (may God have mercy on them).

Fatwa no. 996

Question: Is it allowed for me to give my son something from the Zakat of my wealth?

Answer: The 'ulama (may God have mercy on them) have agreed by consensus that it is not permitted to pay Zakat to those for whose expenditure man is responsible. And at the head of them are origins and branches, and they are parents and children. Imam Ibn al-Mundhir (may God have mercy on him) said: 'The Ahl al-'Ilm have agreed by consensus that Zakat cannot be paid to parents and child in the event that the one paying them is obliged to spend on them.' And this is in terms of the principle so it is not permitted for the father to pay the Zakat of his wealth to his children upon whom he must spend unless the father is unable to spend for his grown children and they are unable to earn provision, like the son who is chronically ill or is able to earn but the earning does not suffice for him and does not fulfil his needs or he is in debt and cannot pay. So in this case some of the Ahl al-'Ilm (may God have mercy on them) permitted the paying of the Zakat to the son. The Sheikh of Islam Ibn Taymiyya (may God have mercy on him) says it is permitted to disburse the Zakat to the parents even if they are higher and to the son even if he is lower if they are fuqara' and he is unable to spend for them and likewise if they are gharimeen. As for the giver of Zakat is rich and can spend for his parents and children, it is not allowed for him to pay them the Zakat as per the opinion of the Ahl al-'Ilm (may God have mercy on them) in general. And God knows best.

Fatwa no. 1005

Question: Are the apostates' wives who live in the Islamic State to be given something from the wealth of Zakat?

Answer: The wife of the apostate and his children living in the abode of Islam: if they are fuqara', they are entitled to Zakat, so they are to be given something from the wealth of the Zakat. And the fact that the husband has apostasised does not mean that the children and wife are to be considered by the offence of the father or husband. This is because of the Almighty's words- 'And the bearer of a burden does not bear the burden of another'- so long as they are in the abode of Islam. And God Almighty knows best.

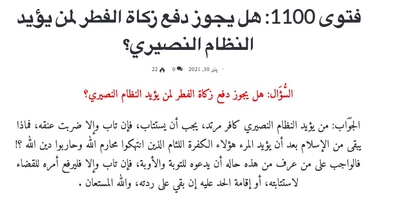

Fatwa no. 1100

Question: Is it allowed to pay Zakat al-Fitr to the one who supports the Nusayri regime?

Answer: The one who supports the Nusayri regime is an apostate disbeliever, who must be asked to repent. So either he repents or you strike his neck. For what remains from Islam after man supports these accursed disbelievers who have violated the taboos of God and have waged war on the religion of God? So the obligation on the one who knows the person whose state is as such is to to call him to repentance and return. So either he repents or that person refers his matter to the judiciary to ask for his repentance, or the hadd punishment is established against him if he remains on his apostasy, and God is the One whose help is to be sought.