Zakat is well-known for being one of the five traditional 'pillars of Islam' and is seen as almsgiving that is made obligatory by the faith and not merely voluntary acts of charity, which usually come under the term sadaqat. The Islamic State, when it controlled territory in Iraq and Syria, unsurprisingly made the concept of Zakat a part of its administrative system, creating a Diwan al-Zakat wa al-Sadaqat ('Diwan of Zakat and Charities') to collect Zakat taxes and charity donations from the population and disburse them to those deemed deserving of the wealth. The group referenced the importance of giving Zakat and its own Zakat activities multiple times in its propaganda (e.g. see this nasheed from Ajnad Media in 2015).

The following Islamic State guide to Zakat that I have translated was published by the group's al-Himma Library, composed by the Diwan al-Zakat wa al-Sadaqat and reviewed by the Research and Fatwa Issuing Commission/Office of Research and Studies. The guide was first published in Rabi' al-Awal 1436 AH (December 2014-January 2015 CE) with second printing in Rabi' al-Thani 1437 AH (January-February 2016 CE). Overall the text serves as a highly readable and useful overview of how the Islamic State conceived the Zakat system, such as the categories of things on which Zakat had to be paid, the minimum threshold values and quantities for paying Zakat, the required quantities and percentages of Zakat payment due, and the various categories of recipients of Zakat. Much of the material here covers familiar ground on Zakat issues and is hardly controversial: the main exception I can think of is the insistence that 'in the cause of God' as a category for recipients of Zakat must mean jihad.

I present the guide in the original text and with translation. The endnotes mostly come from the original text. Where I have decided to insert my own note in commentary or explanation, I have prefaced it by saying it is a 'translator's note.' Hopefully this text can be used as a basis for more detailed study of how the Zakat system functioned under the Islamic State.

Guiding the Guiders in the Jurisprudence of Zakat

Diwan al-Zakat wa al-Sadaqat

al-Himma Library

al-Himma Library

The Islamic State

Caliphate on the Prophetic Methodology

Second Printing

Printing Presses of the Islamic State

Rabi' al-Thani 1437 AH

Contents

Subject:

. Introduction of the Research and Fatwa-Issuing Commission (p. 5)

. Introduction of the Diwan al-Zakat wa al-Sadaqat (p. 6)

. Defining Zakat (p. 7)

. Ruling on Zakat and Its Position (p. 7)

. Ruling on Prevention of Zakat and the Punishment of the One Who Prevents It (p. 8)

. Conditions of the Obligation of Zakat (p. 10).

. Zakat on Debts (p. 11).

. Categories of Things on which Zakat is Obligatory (p. 12).

. Zakat on Gold and Silver (p. 12).

. Zakat on Jewellery (p. 14).

. Zakat on Paper Money (p. 16).

. Zakat on Salaries and Earning of Work (p. 17).

. Zakat on Livestock (p. 18)

. Zakat on Grains and Fruits (p. 27).

. Zakat on Trade Offers (p. 31).

. Zakat on Rikaz (p. 34).

. Masarif of Zakat (p. 35).

. Important Advice for Those Overseeing the Masarif of Zakat (p. 42).

. Conclusion (p. 47).

Introduction of the Office of Research and Studies[i]

In the name of God the Compassionate, the Merciful

Praise be to God, the Self-Sufficient and Praiseworthy, and prayers and peace be upon the one sent with Tawheed, and on his family and companions and those who have gone on the rightly-guided path. As for what follows:

So God Almighty has said: 'Say: this is my path, I call to God upon insight: I do so as well as those who follow me. And Exalted is God. And I am not of the idolaters' (Yusuf 108). So it is not sufficient for the call to be to prayer, Zakat, fasting, the Hajj and jihad etc., but also all that must be upon insight, and the insight is the Shari'i knowledge. Therefore Imam al-Bukhari put the chapter title in his Sahih collection and said: 'Chapter on Knowledge before Word and Deed.'

So just as we are commanded to call the people to Zakat, we also at the same time are commanded to teach the people, so that they should fulfil it upon insight, just as our Lord loves and is pleased, and for the sake of that our specialist brothers in the Diwan al-Zakat have put in place a pleasant summary on the jurisprudence of Zakat in which they have touched upon the most important of its issues. And we- after it was put to us- have reviewed it and checked its issues so it should come out in the most perfect form. And we decided to call it 'Guiding the Guiders in the Jurisprudence of Zakat' asking God Almighty to make it beneficial to all, and to make it of what remains in the land.

And the last of our calls is praise be to God the Lord of the Worlds

And God's peace and blessings be upon the most noble of the Prophets and those sent.

Introduction of the Diwan al-Zakat wa al-Sadaqat

Praise be to God and prayers and peace be upon the Messenger of God, his family, companions and whoso is loyal to him. As for what follows:

So the Almighty has said: 'Those who, when We have enabled them in the land, establish prayer, give Zakat, command what is right and forbid what is wrong. And to God belongs the outcome of affairs' (al-Hajj 41). And after God blessed us with victory and tamkin and raising of the banner of truth and the religion, it was necessary for us for sure to establish the pillars upon which Islam is built, for on the authority of Ibn Omar (may God be pleased with them both): he said: the Messenger of God (SAWS) said: 'Islam has been built on five things: testifying that there is no deity but God and that Muhammad is the Messenger of God, establishment of prayer, the giving of Zakat, the Hajj of the house, and the fasting of Ramadan.'[ii]

So Zakat is the third pillar of those pillars, and which the one God has blessed with tamkin must establish. Therefore we have begun to build this great pillar in theory and practise. As for the theory, it is by writing the studies and printing the pamphlets and issuing the fatwas and putting in place the regulations and instructions. And among those theoretical efforts this short course has been put in place that is the summary of the predominant and appropriate opinions to realise the interests of the religion and the Muslims in this day of ours. As for the practical aspect, it is by the establishment of the Diwan al-Zakat wa al-Sadaqat in all that is required for it from workers, buildings, services, branches, divisions and sub-divisions that cover all the wilayas of the Islamic Caliphate. And from God is granting of success.

Rabi' al-Awal 1436 AH

Defining Zakat:

Zakat as a language term: purity or growth

As a technical term: a part defined in law that is taken from the money of the rich Muslim as purification and cleansing for him, and it is given to those who deserve it as defined by the law.

Ruling on Zakat and its Position

Zakat is an individual obligation on every person in whom the conditions of its obligation are realised, with decisive lines of evidence from the Book, Sunna and consensus of the Ummah.

As for the Book, its verses have been numerous on making Zakat an obligation, such that it has been combined with prayer in 82 verses, among them the Exalted's words: 'And establish prayer and give Zakat' (al-Baqara 110), and the words of the One Whose Majesty is Exalted: 'And take from their wealth a piece of charity by which you may purify and cleanse them' (al-Tawba 103).

And likewise the Prophetic Sunna has brought the affirmation of the obligation of Zakat. For on the authority of Ibn Abbas (may God be pleased with him): that the Prophet (SAWS), when he sent Muadh bin Jabal (may God be pleased with him) to Yemen, he said: 'Indeed you are coming to a people who are People of the Book, so call them to the testification that there is no deity but God and that I am the Messenger of God. So if they obey for that, teach them that God (Almighty and Exalted is He) has imposed upon them five prayers each day and night, and if they obey for that, teach them that God Almighty has imposed upon them a charity from their wealth that is taken from the wealthy of them and rendered unto the poor of them. So if they obey for that, beware about taking the best of their wealth, and beware the call of the oppressed, for there is no veil between it and God.'[iii]

Ruling on Prevention of Zakat and the Punishment of the One Who Prevents It

1. The 'ulama have agreed that the one who stubbornly opposes the obligation of Zakat and denies its obligation, is a disbeliever by consensus, because He is denying the Qur'an and Sunna and denying what is well-known from the religion by necessity.

2. As for the one who admits its obligation and abandons doing it out of miserliness, the majority of the 'ulama have considered that this person is committing one of the great sins, and has fallen under the severe threat of the painful torment on the Day of Judgement, but he does not thus go out from the path so long as he admits the obligation of Zakat. That is supported by the hadith of Abu Huraira (may God be pleased with him) that the Prophet (SAWS), when he mentioned the one who prevents Zakat of gold and silver and mentioned his punishment, he said after that: 'Then he sees his path either to Paradise or to Hellfire'[iv]- and if he had been a disbeliever there would not be for him a path to Paradise.

And his Shari'i punishment in this world is that the Zakat should be taken from him by force along with a portion of his wealth, in accordance with the hadith of the Messenger of God (SAWS): 'And whoso prevents it, we take it along with a portion of his wealth.'[v] And this is the opinion adopted by al-Shafi'i in al-Qadim and Ishad and some of the companions of Ahmad, and it is the pronouncement of Ibn al-Qayyim.[vi]

2. As for the one who abandons fulfilment of Zakat and refrains from that by force in a group and power, that is apostasy from the religion. The Prophet (SAWS) said: 'I have been commanded to fight the people until they testify that there is no deity but God, and that Muhammad is the Messenger of God, and they establish the prayer and give the Zakat. So when they do that, they are granted sacrosanctity from me in their blood and wealth, except in what is held as a legal right upon them, and their reckoning is upon God Almighty.'[vii] And from the legal right upon them is Zakat.

And when the Messenger of God (SAWS) died, and Abu Bakr (may God be pleased with him) became caliph of the Muslims, and those of the Arabs disbelieved, Omar said to Abu Bakr (may God be pleased with them both): 'How do you fight the people and the Messenger of God (SAWS) said: I have been commanded to fight the people until they say...(rest of hadith)?'

Abu Bakr said in his famous pronouncement: 'By God I should certainly fight the one who distinguishes between the prayer and Zakat, for indeed Zakat is the right of wealth, and by God were they to deprive me of an anaq[viii] that they used to pay to the Messenger of God (SAWS) I would fight them because of the deprivation of it.'

So Omar said: 'So by God it was as though God had opened up the heart of Abu Bakr, so I knew that it was the truth.'[ix]

Conditions of the Obligation of Zakat

Zakat only becomes obligatory on wealth by conditions, and these conditions are of two types: the conditions for the one on whom Zakat of his wealth is obligatory, and the conditions on the wealth itself.

The conditions that must be present on the owner of the wealth in order to impose Zakat on him are two:

1. Freedom: so Zakat is not obliged upon the slave, because he does not own, and the master is the owner of what is in his hand, and he (SAWS) said: 'Whoso sells a slave who has wealth, his wealth belongs to the one who sold him unless the buyer makes a condition.'[x]

2. Islam: so there is no Zakat on the disbeliever by consensus, because it is a purifying act of worship, while the disbeliever has no purity so long as he is on his disbelief, so rather we say Zakat is not obliged on his wealth. And we mean by that that we do not obliged him with it until he converts to Islam, for it is not accepted from him, because there is no benefit in obliging him with it. And the Almighty has said: 'The only thing preventing their donations from being accepted from them is that they have disbelieved in God and His Messenger'- (al-Tawba 54). And if the Zakat has become obligatory on him in the case of his Islam and then he apostasises, the obligation does not fall from him by apostasy.

As for the wealth of the minor and the mad one: the Zakat is obligatory on the wealth of the minor and the mad one absolutely,[xi] and it is the pronouncement of the majority, and it is the view narrated from Omar and Ali and Abdullah bin Omar and A'isha and Jaber bin Abdullah (may God be pleased with them).[xii]

And there is not known to them from the companions a person who disagreed except a weak narration on the authority of Ibn Abbas (may God be pleased with them both), and it is not used as proof. This pronouncement is supported by the general mass of texts that indicate the obligation of Zakat on the wealth of the wealthy in an absolute sense, and they have not exempted a minor or a mad person.

The conditions that must be present on wealth for Zakat to be taken from it:

There are conditions on wealth so that Zakat should be taken from it, as follows:

1. That it should be from the types of things on which Zakat is obligatory.

2. That it should reach the nisab.[xiii]

3. That the year should pass upon it (except on crops, fruits and rikaz).

4. That the wealth should be entirely owned, and the evidence for this condition is the idafa construction of wealth with its owners in the Qur'an and the Sunna as in the likes of the Almighty's words: 'Take a charity from their wealth'- (al-Tawba 103).

Zakat on Debts

Debt is of two types:

1. Debt hoping to be fulfilled (hoping to be paid off), in that it should be on a well-to-do debtor who admits the debt, so the Zakat on this is processed with the creditor's current wealth in every year.

2. Debt not hoping to be fulfilled (not hoping to be paid off), in that it should be on a debtor in difficult circumstances whose solvency is not required, or on a person who repudiates the debt without evidence, so Zakat is levied on the debt sum when the creditor receives it according to what has passed from the years.

The types of things on which Zakat is obligatory:

1. The two monies:[xiv] and they are gold and silver.

2. Livestock: and it includes camels, cattle and sheep.

3. Grains and fruits: and it includes all that is measured and stored from them.

4. Trade offers: and it includes all that has been prepared for business with the purpose of profit.

5. Rikaz: and it includes what has been found from the treasure of Jahiliya.

Zakat on Gold and Silver

If the earlier mentioned conditions have been realised in the gold, silver and their owner, so the two things have reached the nisab and the year has passed on them and the like, then one must extract Zakat on them and it will be once per year.

The nisab of gold and silver and the extent of the Zakat on them:

The Messenger of God (SAWS) said: 'When you have 200 dirhams, and the year passes on them, then on them is 5 dirhams, and there is nothing upon you- that is, on gold- until you have 20 dinars, so when you have 20 dinars, and the year has passed on them, then on them is half a dinar.'[xv] And he (SAWS) said: 'There is no charity on that below five awaq of waraq.'[xvi][xvii]

From the two hadiths one draws the following matters:

1. That the nisab of silver is 5 awaq and that equals 200 dirhams of pure silver and equals 590 grams of silver.

And the nisab of gold is 20 dinars and that equals 20 mithqals, which equals 85 grams of 24-carat gold. And it equals 96 grams of 21-carat gold and it equals 113 grams of 18-carat gold.

2. There must be the passing of the year (the whole Hijri year) on the nisab and above so that Zakat should be obligator on it.

3. The extent of the Zakat on gold and silver equals 2.5% and this equals one-fortieth.

Clarification example: a man owns half a kilogram of 24-carat gold, so what is the extent of the Zakat on it when the year passes on it?

We say: the extent of the gold and the thing owned is considered greater than the nisab (58 grams), so there must be 2.5% levied on it, so the necessary extent to be taken= 500 grams x 1/40 = 12.5 grams.

Question: is the gold joined to the silver to complete the nisab?

One is not joined to the other, and it is the madhhab position of the Shafi'is and a narration from Ahmad, and the pronouncement of Abu Obeid and Ibn Abi Layla and Abu Thawr and Ibn Hazem.[xviii] And a number of the contemporary Ahl al-'Ilm have chosen this view except in the event that the two of them are in the form of currency coins.

And they have cited for this the words of the SAWS: 'There is no charity on that below five awaq of waraq'[xix] ; and his words: 'There is nothing upon you- that is, on gold- until you have 20 dinars.'[xx]

The two hadiths show that the one who adds the gold to the silver will have made obligatory the Zakat on each of them beneath its nisab.

Zakat on Jewellery

There is no Zakat on the women's jewellery used for clothing and adornment except when it is in the form of kanz, and kanz means storage. And this is the madhhab of the majority of the Malikis, Shafi'is and Hanbalis, and it is what is narrated on the authority of Ibn Omar, Jaber, Anas, A'isha and Asma' (may God be pleased with them), and it was also asserted by al-Qasim, al-Sha'abi, Qatada, Muhammad bin Ali, Omra, Abu Obeid, Ishaq, Abu Thawr and others besides them.

Imam Ahmad said: 'Five of the companions of the Messenger of God (SAWS) say: there is no Zakat on jewellery.'[xxi]

And al-Baihaqi narrated on the authority of Amro bin Dinar who said: I heard a man asking Jaber bin Abdullah (may God be pleased with him) about jewellery asking if there is Zakat on it? Jaber said: no. So he said: and if the value is reaching 1000 dinars? So Jaber said: more.

And al-Baihaqi narrated also on the authority of Asma' bin Abi Bakr (may God be pleased with them both): that she used to adorn her daughter with gold jewellery and she did not impose Zakat on it, around 50,000.'[xxii]

And in al-Mawta' on the authority of Abd al-Rahman bin al-Qasim on the authority of his father: 'That A'isha (may God be pleased with her) used to adorn the daughters of her brother- widows in her care for them- with jewellery, but no Zakat was taken from their jewellery.'

And in al-Mawta' also: 'That Abdullah bin Omar (may God be pleased with him) used to adorn his daughters and neighbours with jewellery but no Zakat was taken from their jewellery.'

As for what those who assert the obligation of Zakat on jewellery cite, it is either authentic but not clear, or it is clear and not authentic.

Zakat on Paper Money

The principle in people's dealings in the Islamic State is through the gold dinar and the silver dirham- in the renewal of whose use God has blessed the Islamic State- and the nisab of the Islamic dinars and dirhams: there is no disagreement on how to extract it.

As for in places with no authority of the Islamic Caliphate or in areas where people still deal in the paper money, one must know that the Ahl al-'Ilm have mentioned two ways in assessing the nisabs of paper money, and they are

1. Making them analogous to gold.

2. Making them analogous to silver.

And after review of the opinions of the 'ulama for these two paths, and in view of the interest of the religion and with regard to the circumstances of the Muslims in this day of ours, and on account of the need of the poor and their large number, we have chosen to work by the second method, and it is assessing the paper money on the basis of silver in order to realise the interest of the poor and striving to improve the societal situation of the Islamic lands.

And the easiest way to extract the measurement of the necessary Zakat on the paper money is to divide the sum from which Zakat is to be extracted by 40, and the result is the necessary Zakat.

Zakat on Salaries and Earning of Work

The employee or worker person who receives a monthly or weekly salary or the like, is one of two states:

1. He has money that has reached the nisab then he receives the salary money each month as an increase upon it.

This owner is to put in place for himself an account table for his earning in which it details each of the sums that he makes available from the salary and adds to his wealth, and he takes out the Zakat of each sum after the passing of the year upon it from the date of his taking possession of it.

He may also take the Zakat of his wealth when it reaches the nisab since the beginning of the date of reaching the nisab before the year passes upon it, and this is of greater reward and more beneficial to the poor and needy, especially when poverty is spread among the people.

He can do a third thing, which is that he takes out the Zakat al-Safi- after extracting what necessitates his livelihood and those he supports- in every month, then he takes out the Zakat of his wealth that he has when its year passes.

2. He does not have wealth reaching the nisab, and he earns this salary monthly:

So if he saves each month a specific sum, then there is no Zakat obliged upon it, until it reaches the nisab or it completes the nisab with his saved wealth. So then he begins on the account of the year, and it is like the preceding state.

Issue: the ruling of wealth received during the year:

1. If the wealth received is from the profit of money that he has (from its type) like the profit of business wealth and livestock production, this is to be joined to its original, so its year is considered by the year of the original.

2. If the wealth received is from a type of wealth different from the one that he has, such as his wealth being camels, but he receives gold from inheritance and the like, this received wealth has a year reckoned for it from the day it is received if it is nisab, and it is not connected with the year of the original wealth.

3. If the received wealth is from the type of wealth that he has- which has reached the nisab- but this receives wealth is not from the growth of the first wealth, and for example: he has 40 sheep upon which has passed some of the year, then 100 others are bought or granted to him, then he joins the received wealth to the first wealth and he pays Zakat on them entirely when the year of the first is completed.

Zakat on Livestock

The types of animals from which Zakat is to be taken:

The 'ulama have agreed by consensus that Zakat is to be taken from camels, cattle- and among them the buffalo- and sheep- and among them goats- and they cited for that many hadiths.

As for others beyond these defined and specified types of animals, like horses, mules, donkeys and the like- there is no Zakat on them, so long as they are not for business.

On the authority of Abu Huraira (may God be pleased with him): that the Messenger of God (SAWS) said: 'The horse is for three men: for one man it is reward, for another it is a protection, and on another man it is a burden of sin...,' and the Messenger of God (SAWS) was asked about donkeys, so he said; 'Only the following comprehensive verse that includes everything: 'Whoso commits the measure of an atom in good, he sees it, and whoso commits the measure of an atom in evil, he sees it'- (al-Zalzala 7).[xxiii]

The conditions of the obligation of Zakat on livestock:

The following three conditions must be present for Zakat to be imposed on livestock:

1. Reaching the nisab value.

2. Passing of the year.

3. To be sa'im: that is, grazing on the permitted pasture for most of the year.

Types of livestock:

One can divide the livestock (camels, cattle and sheep) into four types and they are:

1. Sa'im: and that is livestock grazing on permitted pasture for most of the year, and they are prepared for milk and offspring, as the Almighty has said: 'And from plants on which you graze your cattle'- (al-Nahl 10). On this there is Zakat.

2. Ma'louf: and if taken for milk and offspring but their owner buys for them fodder or harvests it for them, there is no Zakat on them.

3. 'Amil: like the camels whose owner rents them out for loads on their backs and riding on them, and like the cattle of ploughing and irrigation. There is no Zakat on them in the majority view.[xxiv]

3. Prepared for business: on these are Zakat like trade offers, then there may be Zakat obliged on one camel if its value equals the nisab, whether it is sa'im, ma'louf or ridden.

The nisabs of Zakat on livestock and the obligatory extent of it:

1. Nisabs of Zakat on camels:

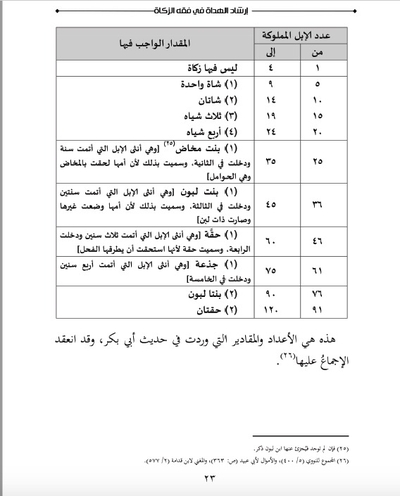

The one who possesses five camels- male or female, young or old- must pay Zakat. On the authority of Abu Sa'id al-Khudri (may God be pleased with him): that the Messenger of God (SAWS) said: 'There is no charity on what is beneath five dhawd[xxv] of camels.'[xxvi]

As for what is beyond five, the Prophet (SAWS) specified the obligatory extents of their Zakat in a hadith of Anas in the letter of Abu Bakr to him, for on the authority of Anas bin Malek (may God be pleased with him) that Abu Bakr (may God be pleased with him) wrote to him this letter when he directed him to Bahrain:

'In the name of God, the Compassionate, the Merciful. This is the obligation of charity that the Messenger of God (SAWS) on the Muslims, and which God commanded to His Messenger. So whoever is asked for it from the Muslims as specified, let him give it, and whoso is asked above it, let him not give it.

On 24 camels and less, from the sheep for every five, one sheep, if it reaches 25 to 35, one bint makhad. And if it reaches 36 to 45, then one bint labun. And if it reaches 46 to 60, then one hiqqa. If it reaches 61 to 75, one jadh'a. If it reaches 76 to 90, two bint labuns. If it reaches 91 to 120, two hiqqas. If it goes beyond 120, then for every 40, one bint labun and for every 50 one hiqqa. And whoso only has four camels, there is no charity on him except what their owner wills. If it reaches five camels, one sheep. And on the charity of sheep for those that graze, if it is 40 to 120, one sheep. And if it goes beyond 120 to 200, two sheep. And if it goes beyond 200 to 300, three sheep. And if it goes beyond 300, then one sheep for every 100.

If the grazing flock of the man is below 40 sheep, there is no charity on them except what their owner wills. And for silver it is 2.5%. But if he only has 190 dirhams, there is nothing on them except what their owner wills.'[xxvii]

According to this hadith, Zakat on camels is taken according to the following table:

Number of camels owned |

Obligatory amount on them |

|

From |

To |

|

1 |

4 |

No Zakat on them. |

5 |

9 |

1 sheep |

25 |

35 |

1 bint makhad[xxviii] [and it is a female camel that has completed one year and entered into the second. It is called as such because its mother has been joined to the makhad which are the breeding stock]. |

36 |

45 |

1 bint labun (and it is a female camel that has completed two years and has entered into the third. It is called as such because its mother has been suckling another besides it and it has begun lactating]. |

46 |

60 |

1 hiqqa [and it is a female camel that has completed three years and has entered into the fourth. It is called a hiqqa because it has been suitable for a male to mate with it]. |

61 |

75 |

1 jadh'a [and it is a female camel that has completed four years and has entered into the fifth]. |

76 |

90 |

2 bint labuns |

And these are the numbers and extents that have come in the hadith of Abu Bakr, and the consensus has been based on them.[xxix]

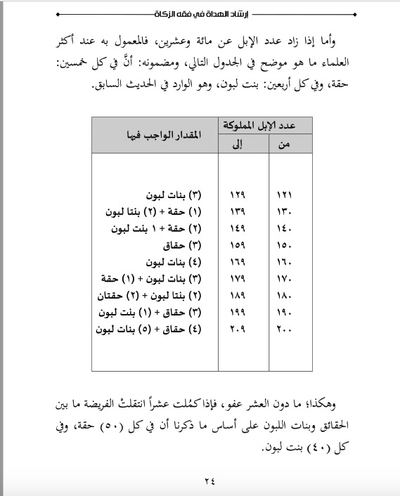

As for when the number of camels has gone beyond 120, the practice in the view of most of the 'ulama is as clarified in the following table, and its essence: that for every 50 you give one hiqqa and for every 40 you give one bint labun. And it comes in the preceding hadith.

Number of camels owned |

Obligatory amount on them |

|

From |

To |

|

121 |

129 |

3 bint labuns |

And so on. What is below the ten is exempt. So if the ten is complete, the obligation moves between the hiqqas and the bint labuns on the basis of what we have mentioned in that for every 50 you give a hiqqa and for every 40 you give a bint labun.

Note: the aforementioned numbers in the table bring together all types of camels (what has one hump or two humps) because the naming of the camels applies to them all.

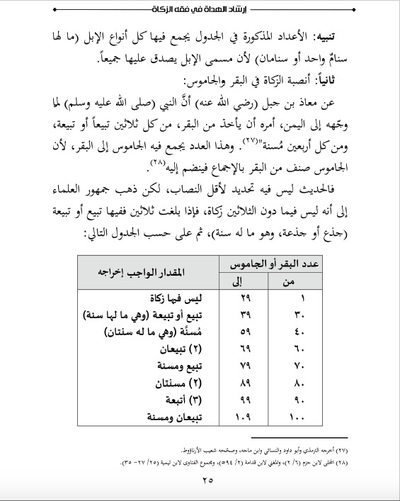

2. The nisabs of Zakat on cattle and buffalo:

On the authority of Muadh bin Jabal (may God be pleased with him) that the Prophet (SAWS) when he directed him to Yemen, ordered him to take from the cattle, from every 30 a tabi' or tabi'a, and from every 40 a musanna.[xxxi] And this number combines in it the buffalo and cattle, because the buffalo is a type of cattle by consensus so it is joined to it.[xxxii]

But the hadith does not have in it specifying the least amount to constitute the nisab, but most of the 'ulama have taken the view that there is no Zakat beneath 30, so if it reaches 30, then upon that is a tabi' or tabi'a (jadh' or jadh'a, and it is what is one year old), then according to the following table:

Number of cattle or buffalo |

Number required to be taken |

|

From |

To |

|

1 |

29 |

No Zakat on them |

And so on for every 30: tabi' or tabi'a, and for every 40: a musanna. So when it reaches 120, he can choose between bringing out 4 tabi's or 3 musannas.[xxxiii]

3. The nisabs of Zakat on sheep:

The 'ulama have agreed by consensus on the obligation of Zakat on sheep, and they have likewise agreed on the sheep including sheep and goats, so they are joined to each other, considering that they are two sub-types of one type.[xxxiv]

And in accordance with what came in the hadith of Anas on the letter of Abu Bakr (may God be pleased with them both) that preceded, Zakat is taken on sheep in accordance with the following table:

Number of sheep |

Number required |

|

From |

To |

|

1 |

39 |

No Zakat on them |

And so on beyond 300, and so for every 100 sheep, one sheep, by the majority view of the 'ulama.

And the sheep that is given in Zakat serves in compensation whether it is from sheep or goats, male or female.

Issue: Zakat for two partners in livestock:

The Zakat on two partners in livestock will be like the Zakat of one for the hadith: 'There is no gathering between separated and no separation between gathered in order to avoid giving charity.'[xxxv]

Therefore the conditions of Zakat of partnership are the same conditions as the Zakat of one person except that to them are added another conditions and it is that the wealth of one of the partners should not be distinguished from the other in six respects: pasture, accommodation, watering place, milking place, the male sheep, and the shepherding.

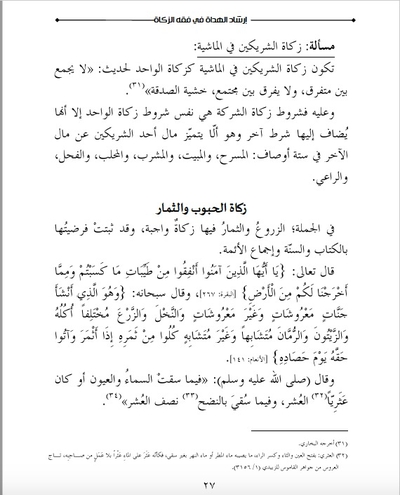

Zakat on Grains and Fruits

In general, crops and fruits have obligatory Zakat on them, and the obligation of that has been proven by the Book, Sunna and consensus of the Imams.

The Almighty has said: 'Oh you who have believed, spend from good things what you have gained and what We have brought out for you from the land'- (al-Baqara 267). And the Exalted has said: 'And He is the One who has caused gardens- both trellised and untrellised- to grow along with date palms and crops of various tastes as well as olives and pomegranates- alike and unalike. Eat from their fruit when they ripen and give their due when you harvest them'- (al-An'am 141).

And SAWS said: 'In what the sky and springs have watered or has been 'athari,[xxxvi] a tenth, and in what has been watered by nadhh,[xxxvii] half a tenth.'[xxxviii]

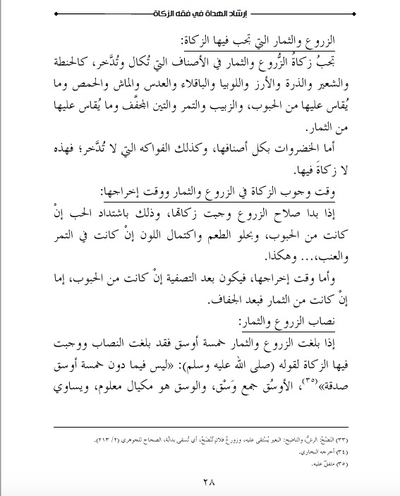

The crops and fruits on which Zakat is obligatory:

Zakat of crops and fruits is obligatory on the types that are measured and stored, like wheat, barley, corn, rice, beans, broadbeans, lentils, mung beans and chickpeas and similar grains, and dried raisins, dates, figs and similar fruits.

As for vegetables in all their types, and likewise fruits that are not stored, there is no Zakat on them.

The time when Zakat is obligatory on the crops and fruits and the time to take it out:

When the ripeness of the crops appears their Zakat is obligatory, and that is when the grain hardens if it is of the grains, and by the sweetness of the taste and the perfection of the colour when it comes to fruits and grapes, and so on.

As for the time of taking out the Zakat on them, it should be after purification when it comes to grains, and after drying for the fruits.

The nisab of the crops and fruits:

If the crops and fruits reach five awsuq then they reach the nisab and Zakat on them becomes obligatory on account of the words of SAWS: 'There is no charity on what is beneath five awsuq.'[xxxix] And awsuq is the plural of wasq, and the wasq is a well-known measurement, and it equals 60 sa' and the sa' is 4 amdad, and the madd is the handful in the palms of the average man. It[xl] also equals the filling up of a vessel that has the capacity for around 647 kilograms of wheat.

Issue: are crops joined to each other to complete the nisab?:

The words of the 'ulama have shown that sub-types of the one type are joined to each other, but the different types are not joined, so wheat is not joined to barley and the like, and the various types of pulses are not joined to each other, and the chickpeas are not joined to the broadbeans and lentils and the like.'[xli] And this is the position of the majority of the predecessors.

'As for the types of wheat, they are joined to each other, and likewise the types of wheat are joined to each other, and likewise the types of dates are joined to each other'[xlii] even if their names differ and the gardens that the man owns are distant from each other.

Issue: khars of date palms and grapes:[xliii]

Khars linguistically: estimation of what is on the date palm in terms of ripe dates, and I have applied khars to the date palm.[xliv]

And as a technical term: it is the effort in estimating the quantity of crops and fruits after drying so that the extent of the necessary Zakat incumbent on their owners can be known, so the one performing khars makes them choose between preserving them until they dry, or eating from them before drying, with the guarantee of the right of the poor on them.

For on the authority of Abu Humaid al-Sa'adi who said: We performed a ghazwa with the Prophet (SAWS) at Tabuk, so when he came to Wadi al-Qura, behold a woman was in a garden of it so the Prophet (SAWS) said to his companions: 'Perform khars.' And the Messenger of God (SAWS) estimated 10 awsuq. So he said to her: 'Count what is come to out from this.' Then he said to the woman: 'How much as your garden brought forth?' She said: 10 awsuq, the khars of the Messenger of God (SAWS).[xlv]

And on the authority of A'isha (may God be pleased with her) who said: 'The Messenger of God (SAWS) used to send Abdullah bin Rawaha so he would perform khars on the date palms when they would begin to grow ripe before anything should be eaten from them, then he made Jews choose: they could take the fruit in that khars or they could render the fruit to them in that khars, so that the Zakat could be calculated before the fruits should be eaten and separated.'[xlvi]

Issue: the extent of Zakat due on crops and fruits when they reach the nisab:

The extent due on Zakat of crops and fruits differs according to the different means of watering: (provision of water):

1. What has been watered without use of artificial mechanisms- from irrigation canals and machines- is to have 10% extracted from it.

2. And what has been watered by use of the mechanism or with purchased water, 5% is due on it, and the evidence is the hadith of Ibn Omar (may God be pleased with them both) that the Prophet (SAWS) said: 'In what the sky and springs have watered or has been 'athari a tenth, and in what has been watered by nadhh, half a tenth.'[xlvii]

Also there is the hadith of Jaber (may God be pleased with him) from the Prophet (SAWS) who said: 'Concerning what the rivers and clouds have watered: tenth shares. And concerning what has been watered by the saniya,[xlviii] half-tenth shares.'[xlix]

3. So if the land is watered half of the time by expenditure and half of the time without it, the Zakat is 7.5% by agreement.

4. And if it is watered by one method more than the other, the majority view is to consider the main method, and the ruling of the lesser one does not apply. And it has been said: each of the two is to be considered by its share.

5. And if the main extent is unknown, 10% is extracted as a precautionary measure, because the principle is the obligation of the 10%, but rather it becomes invalid by the presence of the expenditure.[l]

Zakat on Trade Offers

Trade offers means everything except the two monies (gold and silver) from goods, real estate, types of animals and crops, clothes, machines, jewels and the like from what is prepared for business.

And some of them have defined it as being what is prepared for selling and buying with the intention of profit.

Ruling on Zakat on trade offers:

The majority of the 'ulama have asserted the obligation of Zakat on trade offers and some of them have said that it is the consensus of the companions and the followers and they have cited the Book, Sunna and traces of the companions and the followers.

- For from the Qur'an: the Almighty's words: 'Oh you who have believed, spend from good things what you have gained and what We have brought out for you from the land'- (al-Baqara 267). And the meaning of His words ('what you have earned'): business.[li]

And al-Bukhari put a title in the Book of Zakat in his Sahih collection and said: 'The chapter of charity of earning and business.'

- And from the Sunna: the generality of the words of the Prophet (SAWS) to Muadh (may God be pleased with him): '...and teach them that God has imposed on them charity from their wealth...'

- And from the traces of the companions and the predecessors: on the authority of Ibn Abd al-Qari who said: 'I was overseeing the Bayt al-Mal in the time of Omar bin al-Khattab, so when the giving came out, he would add together the wealth of the businessmen then calculate it- what was present and absent of it- then he took the Zakat from the wealth that was present on the basis of what was present and absent.'[lii] And on the authority of Ibn Omar (may God be pleased with them both): he said: 'There is no Zakat on offers, except what was been for business.'[liii]

And on the authority of Ibn Abbas (may God be pleased with them both) who said: 'There is no problem in waiting until he sells, and Zakat is obligatory on him.'[liv]

Zakat on trade offers requires the following conditions:

1. That the offers should not be of what requires Zakat on it originally, like livestock, gold, silver and the like, because two Zakats are not brought together according to consensus, but rather there should be on them Zakat of kind- as per the predominant opinion- because Zakat of kind is more strongly established than Zakat of trade in order for the consensus to be formed upon it. And whoso deals in what is beneath the nisab of kind, brings out Zakat of trade.[lv]

2. That it should reach the nisab, and it is the nisab of money (590 grams of silver).

3. The passing of the year.

Issue: how does the businessman pay Zakat on his trade assets?

When the due date of Zakat comes, the businessman must combine the different parts of his wealth to each other, and this wealth includes:

1. Capital, profits and reserves and the value of his goods.

2. Debts hoping to be fulfilled.[lvi]

So he assesses the value of the goods and adds them to what he has from money, and to what he has from debts hoping to be fulfilled, but if he has a debt upon him he must pay it, so if the remaining wealth reaches the nisab, he is to take out from it a quarter of a tenth.

Then he takes out from all of this a quarter of a tenth (2.5%) according to the price of selling the goods at the time of taking out the Zakat, and not according to the price of their purchase, and by the value of the totality and not the individual good.

Issue: is Zakat to be taken out from the kind of the goods or from their value?

Here one should consider the interest of the one deserving the Zakat. For if the interest is realised in taking from the kind of the goods, Zakat is to be taken out from the kind of good, and if the interest is realised in taking it out from its value, then the Zakat is taken out from its value. And this is what the Sheikh of Islam Ibn Taymiyya adopted,[lvii] and he is close to the opinion of Abu Hanifa and al-Shafi'i- in one of his pronouncements- in that the businessman is to be allowed to choose between bringing out the commodity or the value[lviii] if in that he intends what is more just and beneficial for the person deserving.

Zakat on Rikaz

Rikaz linguistically speaking: the one who buries something when he hides it. And from it the Almighty's words: 'And how many generations did We destroy before them? Do you sense anything form any one of them or hear a rikz of them?'- (Maryam 98): i.e. a hidden voice.

And as a technical term: it is what has been found buried from the treasure of Jahiliya and their jewels and wealth, and it is known by the writing of their names, and the depiction of their images, and the like. But if upon it is the sign of Islam, it is luqta and not a treasure.

And rikaz has Zakat on it, and its extent is the fifth share,[lix] without consideration of the nisab, so the obligation of Zakat of rikaz applies absolutely in its small and large quantity, just the passing of the year is not conditional on it.

And the evidence for these aforementioned rulings is the hadith of Abu Huraira (may God be pleased with him): that the Prophet (SAWS) said: 'On rikaz is the fifth share.'[lx]

As for the masraf of Zakat of rikaz, the matter goes back to the Caliph of the Muslims and their Imam, who disposes it wherever the interest requires it.[lxi]

Masarif of Zakat

Zakat is a right of God Almighty on the wealth of the wealthy Muslim as purification and cleansing for him. The Almighty has said: 'Take from their wealth a charity by which you purify and cleanse them and pray for them. Indeed your prayer is a resassurance for them, and God is hearing and knowing'- (al-Tawba 103).

And so long as it is the right of God Almighty, so indeed the masarif have been classified by the Exalted into eight branches. No one has the right to increase or diminish them. And these branches are the masarif brought together in the Almighty's words: 'Indeed the charities are for fuqara' and the masakin and the 'amileen alayha and the mu'allafa qulubuhum and for the riqab and the gharimeen and fi sabeel Allah and ibn al-sabeel as an obligation from God and God is knowing, wise'- (al-Tawba 60).

1. The fuqara': they are those who do not fight sufficient means to live, or they find some of it and lack another part of it.

2. The masakeen: they are the ones who refrain from asking and the people do not realise their poverty because of their moral character and uprightness. So the addition of them to the fuqara' in conjunction has come under the aspect of adding the particular to the general in conjunction. For on the authority of Abu Huraira (may God be pleased with him) that the Messenger of God (SAWS) said: 'The maskeen is not the one who goes around to the people to be turned away with the morsel and two and the date and two dates, but rather the maskeen is the one who finds no wealth to avail him and no one notices so that he should be given charity and he does not arise and ask the people.'[lxii] And it has been said that the addition of the masakeen to the fuqara' in conjunction is a conjunction of contrast, so the fuqara' are those who do not find sufficiency to live and the masakeen are those who have some of the sufficiency but lack another part of it.

3. The 'amilun 'ala al-Zakat: and they are the collectors, preservers and dividersof the Zakat and others of those who participate in establishing this great pillar and its service. As for when they have a salary from the Imam, they are not given from the Zakat unless the salary is insufficient.

4. Al-Mu'allafa Qulubuhum: and these people are upon two state of affairs

1. When there are force, tamkin and the predominance of Islam, so there is giving:

a) To the one who has converted to Islam and his intention is weak, in order to please him and gratify his soul in Islam.

b) To the one who has honour among the Muslims, whereby it is expected that in giving him something from the Zakat, others besides him will profess Islam.

2. When there are weakness and predominance of the disbelievers, there is giving:

a) To the one whose profession of Islam is hoped through giving to him.

b) To the one whose evil will be kept away, along with the evil of others with him, through giving to him. And the lines of evidence for this detailing is as follows:

- On the authority of Sa'id bin al-Musayyib on the authority of Safwan bin Umayya who said: 'The Messenger of God (SAWS) gave to me on the Day of Hunayn and he was indeed the most hated of people to me so he continued to give to me until it got to the point that he became the most beloved of people to me.'[lxiii]

- On the authority of Abu Sa'id (may God be pleased with him): that Ali (may God be pleased with him) sent some gold in its ore from Yemen to the Prophet (SAWS), so he divided it among four people: al-Aqra' bin Habis, Uyayna bin Badr, Alqama bin Ulatha and Zaid al-Khayr. And he said: 'I am placating them.'[lxiv]

- It has been narrated that Uyayna and al-Aqra' came demanding land from Abu Bakr (may God be pleased with him), so he assigned that in writing, but Omar (may God be pleased with him) tore it up and said: this is something the Messenger of God (SAWS) gave you in conciliation for you, but as for today, God has made mighty Islam and has dispensed of you, so either you have been steadfast upon Islam, or there is between us and you the sword. So they returned to Abu Bakr and said: are you the Caliph or Omar? You assigned to us in writing and Omar tore it up. So Abu Bakr (may God be pleased with him) said: he is if He wills. And Abu Bakr agreed with Omar on that, and no one of the companions (may God Almighty be pleased with them) condemned him.[lxv]

5. Fi al-riqab, and they are two types:

a) al-Riqab al-Muslimun, mukatab and non-mukatab.[lxvi]

b) Prisoners of the Muslims held by the disbelievers.

And the lines of evidence for that:

- God (Almighty and Exalted is He) said: 'If only that person had taken on al-aqaba. And what will make you realise what is al-aqaba? It is to free a slave, or feed in a time of famine an orphaned relative or a maskeen in distress'- (al-Balad 11-16).

- On the authority of Abu Huraira (may God be pleased with him) said: the Prophet (SAWS) said: 'Whichever man frees a Muslim man from slavery, God will save from the Hellfire a part of that person for every part of the freed slave.'[lxvii]

- On the authority of Humaid bin Abd al-Rahman who said: Omar (may God be pleased with him) said: 'For me to save a man from the Muslims from the hands of the disbelievers is more beloved to me than the entire Arabian Peninsula.'[lxviii]

6. The gharimun: and they are the ones overwhelmed by debt and thus unable to pay it.

And this masraf is on two states:

a) Direct: and it is that there should be disbursement from the wealth of the Zakat to the gharim himself directly.

b) Indirect, and this is of three types:

- To fix relations between the creditor and the debtor so that there should occur no adversity and enmity between them, so a third man making amends comes bearing the debt of the debtor and gives it to the creditor.

And this is what is called hamala as came in the hadith of Qabisa bin Mukhariq al-Hilali (may God be pleased with him): he said: I bore the hamala so I came to the Messenger of God (SAWS) asking him about it so he said: 'Wait until the charity should come to us so we can command you by it.' Then he said: 'Oh Qabisa, indeed begging is not valid except for one of three instances: a man who has carried hamala so he is allowed to beg so that he should obtain it, then he should abstain...so what is besides these things from begging, oh Qabisa, is an illegal possession its owner eats up as an illegal possession.'

- For the gharim: for him or his clan liable to pay blood money if they lack the means to pay the blood money in manslaughter or murder. For on the authority of Anas (may God be pleased with him) that the Prophet (SAWS) said: 'Begging is only allowed for three instances: for the one of wretched poverty, for the one under terrible debt, or the one liable to blood money he cannot pay.'[lxix]

- To pay the debt of the dead person, and that if is he has no left behind what is sufficient to pay his debt. For on the authority of Abu Huraira (may God be pleased with him) from the Prophet (SAWS) who said: 'I am closer to the believers than they are themselves, so whoso dies and has debt and has not left the means to pay, we must pay it off.'[lxx]

7. Fi sabeel Allah,[lxxi] and it is jihad, because when the expression fi sabeel Allah is used in the Book and Sunna, only jihad is meant by it, therefore under this masraf come two types:

a) Raiders fi sabeel Allah from volunteers who do not have a share in the Diwan, so they are given from Zakat the means by which they can prepare themselves for war from vehicle transport, weapons and expenditures, and likewise for the one whose share in the Diwan does not suffice for him, so he is given what suffices to fulfil his preparation and expenditure.

b) The interests of war and fighting fi sabeel Allah, like digging trenches, building walls, keeping watch over the enemy and preparing weapons and war vehicles and machines and other things from what serves the interest of the fighting.

8. Ibn al-Sabeel: and it is the wandering traveller who passes through a land and uses up his wealth and cannot reach his intended destination or return to his abode so he deserves his share form Zakat to the extent that it suffices for him. And that is on conditions:

- His travel should be for a legitimate or permitted purpose, like seeking 'Ilm, or business, or visiting a friend or treatment and other such purposes.

- That his travel should not lead to an act of disobedience.

- That he should not travel to the abode of disbelief for the purpose of tourism, leisure or residence.

Important Advice for Those Overseeing the Masarif of Zakat

Those overseeing the works of the masarif of Zakat must be people of jurisprudence and awareness on disbursing the wealth of Zakat according to the branches that God Almighty mandated, in obedience to the Exalted in establishing this great pillar of the pillars upon which our Hanif religion arises.

And in what follows is a summary of the most important matters that the overseer of the disbursement of Zakat must fully appreciate as he undertakes this exalted work, and it is the summary of the predominant opinions of the Imams of jurisprudence in what is appropriate for state of the Islamic Ummah in its present day, after it has returned again living under the shade of the banner of the Islamic Caliphate. And these pieces of advice are:

1. The overseer of the disbursement of the Zakat must know that disbursement of Zakat on its eight masarif has two ways:

1. The disbursement of the wealth by those upon whom the Zakat is obligatory by themselves to those who deserve it from the eight branches, through consultation of those who know the circumstances of the people and those working by the interests of the religion and the Muslims. And this way should be in the event of the lack of presence of a state and authority for the Muslims.

2. That the wealth of the Zakat should be handed over to the Diwan al-Zakat in the Islamic State, and its disbursement should be by the one overseeing the masarif of Zakat to the eight categories of people who deserve it, in accordance with what the overseer sees to be in the interest of the religion and the Muslims according to the Shari'i regulations. And this way should be in the event of the presence of a state and authority for Islam, and it is what has been realised- thanks be to God- by the announcement of the Caliphate in last Ramadan of the past year: 1435 AH

2. The overseer of the masarif of Zakat must be a person of awareness of the eight masarif that God the Exalted and Almighty defined in His Noble Book, and the Imams of jurisprudence clarified in interpretation, explanation, formation of rules and derivations, so that he can choose the most weighty and most just means in realising the interests of the religion and the Muslims.

3. The overseer of the masarif of Zakat must know that Zakat is not permitted to the following categories:

1. The disbeliever: by consensus, except what has been exempted in the masraf of mu'allafa qulubuhum.

2. The rich, and likewise the strong one capable of earning: for on the authority of Abdullah bin Amro (may God be pleased with him) from the Prophet (SAWS) who said: 'Charity is not permitted for a rich person or the one who is strong and sound of limbs.'[lxxii]

3. The fool: this is because of the Almighty's words: 'And do not give the fools your wealth that God has made as a support for you, but rather give them provision in it and clothe them and say to them a kind word'- (al-Nisa' 5). So the fool is not given the wealth of Zakat directly because he is not good at making use of it, and so the disbursement for him, if he is poor, should be to a guardian of his.

4. The grossly immoral: the one who spends his wealth on acts of disobedience. If he is given the wealth of Zakat, it will assist him in his gross immorality and his acts of disobedience.

5. The one whereby the person entrusted with his sponsorship is rich, from origin, derivation or wife: so the father does not give the Zakat of his wealth to his young son because he is a guarantor for spending on him, and likewise the son does not give the Zakat of his wealth to his disabled poor father because he is likewise a guarantor for spending on him. And likewise the husband is a guarantor in spending for his wife so it is not permitted for him to give her the wealth of his Zakat.[lxxiii]

6. The family of the household of the Messenger of God (SAWS): and they are the Banu Hashim and their clients. This is because of many hadiths that have come on that matter, among them the words of SAWS: 'Indeed charity is not permitted to us, and indeed the clients of my people are from among them.'[lxxiv] And also the words of SAWS: 'Indeed charity is not allowed for Muhammad or the family of Muhammad, but rather it is for the lowly of the people.'[lxxv]

7. Those to whom the prohibition applies in the hadith of Qasiba previously mentioned: 'So what is besides these things from begging, oh Qabisa, is an illegal possession its owner eats up as an illegal possession.'[lxxvi]

4. The one overseeing the masarif of Zakat must observe in the disbursing of Zakat what is of greater priority and obligation for establishing the religion and building the Islamic society in accordance with the law of God (Almighty and Exalted is He), a building that realises conciliation and brotherhood and aids the cause of piety and fear of God and builds justice, good and mutual support and affection, and strengthens the unity of the rank of the Muslims and supports the people of force upon which the State of the Islamic Caliphate arises.

5. The overseer of the masarif of Zakat must avoid in disbursing the Zakat the whims of the soul and the overcoming of emotion that takes him out from the regulations of the law. He must give predominance to the general interests over the particular ones, and he should avoid oppression, and indeed he should expend his effort in being fair to the deserving and being fair in disbursing of the wealth. The Almighty said: Indeed God commands justice, doing good and dealing kindly with relatives. And He forbids gross immorality and condemned acts and transgression. Thus He admonishes you: perhaps you should remember'- (al-Nisa' 90).

6. The overseer of the masarif of Zakat must deal with the deserving in a compassionate and humble manner without arrogance and haughtiness, and he must be gentle in words and gentle in heart and good-mannered and welcoming, following the manners of the Messenger (prayers and peace be upon him) in his dealing with the people, just as has come in the Exalted's words: 'There has come to you a messenger from among yourselves, noble, upon whom is what you have suffered, keen for you, merciful and gentle with the believers'- (al-Tawba 128).

7. The overseer of the masarif of Zakat must know that the wealth that he disburses to the deserving of it is a right for them from God Almighty, and he is obliged to undertake this right and convey it to its people, so there is no grace and no right for him in it, and indeed he has nothing from it except the remuneration and reward if he is sincere in the intention in this noble work.

Conclusion

This is what has been possible to prepare from chapters and sections on Zakat and the most important issues connected with it. And we hope it will be helpful to the overseer and the subjects, in which the ignorant can take guidance and the knowledgeable can use for revision.

So we ask God for acceptance and the right path, and guidance and integrity. And the last of our prayers is praise be to God the Lord of the Worlds. And God's blessings and peace be upon our Prophet Muhammad and all his family and companions.

Diwan al-Zakat wa al-Sadaqat

Rabi' al-Awal 1436 AH

Done, thanks be to God.

al-Himma Library

Islamic State

A book guides and a sword gives victory.

The printing presses of the Islamic State

Rabi' al-Thani 1437 AH.

[i] [Translator's note]: the difference in the title of this institution from that on the content page is that between the time of the first and second printings, the name of the institution was changed from the Research and Fatwa-Issuing Commission to the Office of Research and Studies. The office was eventually dissolved.

[ii] Agreed upon.

[iii] Agreed upon.

[iv] Brought out by Muslim.

[v] Brought out by Ahmad and Abu Dawud and al-Nisa'i, and Shu'aib al-Arna'out deemed it sound.

[vi] Nil al-Awtar (4/147).

[vii] Agreed upon.

[viii] The anaq: the offspring of the goat, so when four months comes upon it and it is separated from its mother and grows strong on the pasture, it is jaddi, while the female is anaq. And when the year comes upon it, the male is tays and the female is anaz, and it is based on the fact that when the sheep are all young, their mothers die in some of the year, so when the year of the mothers passes, the young sikhal are taken in zakat as per the year of the mothers whether anything remains of the mothers or not. And as for the mention of the anaq, it comes under the issue of reduction, so only the thanni is taken in the realm of Zakat. Sharh al-Nawawi on Muslim (9/99), and Faydh al-Bari Sharh Sahih al-Bukhari by Ibn Hajar (3/140).

[ix] Agreed upon.

[x] Agreed upon.

[xi] Al-Mahalla by Ibn Hazem (5/301) and al-Majmu' al-Nawawi (5/329) and Majmu' al-Fatawa by Ibn Taymiyya (25/17).

[xii] Musannaf Abd al-Razzaq, and Musannaf Ibn Abi Shaiba, and Sunan al-Baihaqi, and al-Mahalla of Ibn Hazem (5/208), and al-Amwal by Abu Obeid (p. 448).

[xiii] [Translator's note]: the minimum quantity or value of something in order for Zakat to be obligatory upon it.

[xiv] [Translator's note]: referred to as such because gold and silver were used as dinars and dirhams respectively. The Islamic State sought to revive this practice.

[xv] Brought out by Ahmad, Abu Dawud, al-Tirmishi, al-Nisa'i and Ibn Majeh, and deemed sound by al-Hafiz and Shu'aib al-Arna'out.

[xvi] Awaq: plural of awqiya and it equals 40 dirhams by agreement. So five awaq equal 200 dirhams, And the waraq with fatha on the waw and kasra on the ra: silver.

[xvii] Agreed upon.

[xviii] Al-Muhalla by Ibn Hazem (6/83).

[xix] Agreed upon.

[xx] Brought out by Ahmad, Abu Dawud, al-Tirmishi, al-Nisa'i and Ibn Majeh, and deemed sound by al-Hafiz and Shu'aib al-Arna'out.

[xxi] Al-Mughanni by Ibn Qudama (3/42).

[xxii] Tuhalliha with tashdid on the lam with kasra: she put jewellery on her: al-Sihah fi al-Lugha by al-Jawhari (1/146).

[xxiii] Agreed upon.

[xxiv] Sharh Fath al-Qadir 'ala al-Hidaya by al-Skandari (1/509) and al-Mughanni by Ibn Qudama (2/576).

[xxv] Dhawd of camels: between three to ten, and they are female and there is no singular of expression. al-Sihah fi al-Lugha by al-Jawhari (1/231).

[xxvi] Agreed upon.

[xxvii] Brought out by al-Bukhari.

[xxviii] If not available, a male ibn labun should be given instead of it.

[xxix] Al-Majmu' al-Nawawi (5/400) and al-Amwal by Abu Obeid (p. 363) and al-Mughanni by Ibn Qudama (2/577).

[xxx] [Translator's note]: the calculation here should actually be 4 hiqqas or 5 bint labuns, not the two combined as the table erroneously states here.

[xxxi] Brought out by al-Tirmidhi and Abu Dawud and al-Nisa'i and Ibn Majeh, and deemed authentic by Shu'aib al-Arna'out.

[xxxii] Al-Muhalla by Ibn Hazem (6/2), and al-Mughanni by Ibn Qudama (2/594), and Majmu' al-Fatawa by Ibn Taymiyya (25/27-35).

[xxxiii] Majmu' al-Fatawa by Ibn Taymiyya (25/37).

[xxxiv] Al-Majmu' by al-Nawawi (5/417), and Majmu' al-Fatawa by Ibn Taymiyya (25/30-35).

[xxxv] Brought out by al-Bukhari.

[xxxvi] 'Athari: with a fatha on the ayn and tha' and a kasra on the ra'. What is fed by rainwater or river-water without irrigation, as though it has found water without work from its owner. Taj al-Urus min Jawahir al-Qamous by al-Zubaidi (1/3156).

[xxxvii] Nadhh: spraying; and nadhih: the camel used to draw water, and the plants of so-and-so are sprayed: i.e. watered by a riding animal. Al-Sihah by al-Jawhari (2/213).

[xxxviii] Brought out by al-Bukhari.

[xxxix] Agreed upon.

[xl] [Translator's note]: i.e. the nisab on grains and fruits.

[xli] Al-Majmu' by al-Nawawi (5/511-513).

[xlii] Al-Muhalla by Ibn Hazem (5/253).

[xliii] [Translator's note]: i.e. whereas other products and assets on which Zakat is due require precise calculation, it is permissible to perform an approximate estimate for dates and grapes.

[xliv] Al-Sihah fi al-Lugha by al-Jawhari (1/167).

[xlv] Agreed upon.

[xlvi] Brought out by Abu Dawud and deemed authentic by Shu'aib al-Arna'out.

[xlvii] Brought out by al-Bukhari.

[xlviii] Saniya: the female camel through which lands are watered, wa qad sanat: when she has provided water. And the plural is sawani. Al-Muheet fi al-Lugha by Ibn Abad (2/277).

[xlix] Brought out by Muslim.

[l] Al-Mughanni by Ibn Qudama (2/699).

[li] Tafsir al-Tabari (5/555) and Ahkam al-Qur'an by Ibn al-Arabi (1/235) and others besides these two.

[lii] Musannaf of Ibn Abi Shaiba, and al-Amwal by Abu Obeid, and al-Mahalla by Ibn Hazem.

[liii] Brought out by al-Shafi'i in al-Umm (2/68), and Abd al-Razzaq in his Musannaf (4/97) and al-Baihaqi in his Sunan (4/147) with authentic chain of transmission.

[liv] Al-Amwal by Abu Obeid (p. 426) and al-Mahalla by Ibn Hazem (5/234).

[lv] Al-Majmu' by al-Nawawi (6/50) and al-Mughanni by Ibn Qudama (3/43).

[lvi] [Translator's note]: i.e. debt owed to the businessman.

[lvii] Majmu' al-Fatawa by Ibn Taymiyya (25/80).

[lviii] Bada'i al-Sana'i' by al-Kasani (2/21) and al-Mughanni by Ibn Qudama (3/31).

[lix] [Translator's note]: i.e. 20%.

[lx] Agreed upon.

[lxi] Al-Amwal by Ibn Zanjawi (3/76).

[lxii] Agreed upon.

[lxiii] Brought out by Muslim.

[lxiv] Agreed upon.

[lxv] Rouh al-Ma'ani fi Tafsir al-Qur'an al-Adhim wa al-Saba' al-Mathani by al-Alusi (10/122), and Katar al-Umal fi Sunan al-Aqwal wa al-Af'al by Ala' al-Din al-Hindi (1/31).

[lxvi] [Translator's note]: mukatab refers to a type of slave under a contract of release with the master.

[lxvii] Agreed upon.

[lxviii] Narrated by Ibn Abi Shaiba in his Musannaf, and Ibn Zanjawih in al-Amwal, and brought by Abu Yusuf in al-Kharaj.

[lxix] Narrated by Ahmad and Dabu Dawud and Ibn Majeh. Deemed sound by al-Tirmidhi and its chain of narration classified as weak by Shu'aib al-Arna'out.

[lxx] Brought out by al-Bukhari.

[lxxi] [Translator's note]: 'in the path of God.'

[lxxii] Narrated by Abu Dawud and al-Tirmidhi, who deemed it authentic.

[lxxiii] [Translator's note]: as contained in the original text but probably should have been intended as 'Zakat of his wealth.'

[lxxiv] Narrated by Ahmad and Abu Dawud and al-Nisa'i and al-Tirmishi, who deemed it authentic.

[lxxv] Brought out by Muslim.

[lxxvi] Brought out by Muslim.